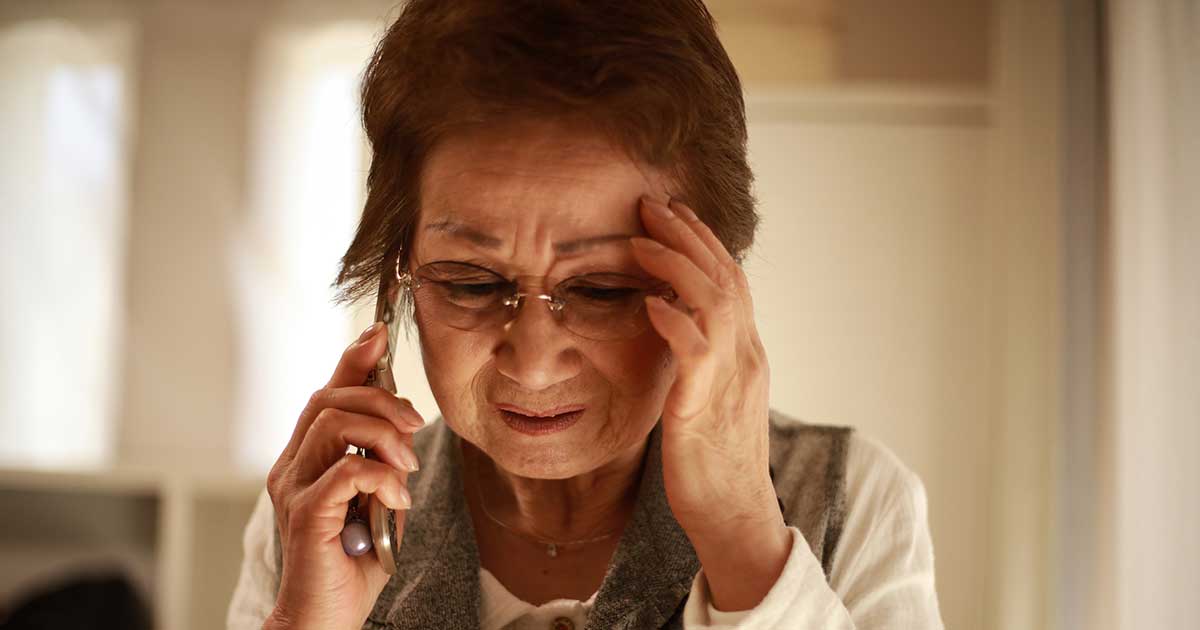

Imposter scams, also known as impersonation or fraud, involve a scammer pretending to be someone else to trick the victim into giving them money or personal information. The scammer may pretend to be a government official, a representative from a well-known company, or even a family member or friend.

Are You Falling for Imposter Scams? Learn How to Protect Yourself Now!

Small business owners spend hours each week recording, organizing, and processing financial transactions – everything from accounts receivable and payable, to employee payments, expense receipts and supplier invoices.

You know that feeling when you walk out of the salon, freshly trimmed, and styled, and suddenly realize how much money you just spent? Well, we're here to help. In this article, we'll give you three simple ways to save on your next salon visit.

When you're starting a new business, budgeting is one of the most important things you can do to ensure your success. It can be tricky, though, to know where to start and what to include in your budget. That's why we're here to help!

So, you've decided to add a furry friend to your family. That's great! Pets are a wonderful addition to any home and can provide years of companionship and love. But before you go running to the nearest animal shelter or pet store, it's important to take a step back and do some financial planning.

You're probably familiar with the saying, "If it ain't broke, don't fix it." But what about when it is broke? What if you're paying for a cable package that you never use, or you're shelling out for a service that doesn't fit your needs? It might be time to consider streaming.

You're at the checkout, and the clerk is asking for your payment. You swipe your card and hand over the coupon you've been waiting to use. The total comes to $10, but with the coupon, it's only $8. You're happy with your savings until you realize that you could have done even better.

When it comes to your money, it's important to choose the bank that's right for you. That might mean a big bank with a lot of branches and ATMs, or it might mean a smaller bank that offers more personalized service.

You've just come up with the next big thing. A product or service that's going to change the world. But there's one minor problem: you need money to make it a reality. So how do you finance your startup?

So, you're considering taking out a loan. That's great! Borrowing money can be a powerful tool to help you reach your financial goals.

But before you sign on the dotted line, it's important to understand what you're getting into. This guide will give you a basic understanding of loans and what to look for before you borrow.